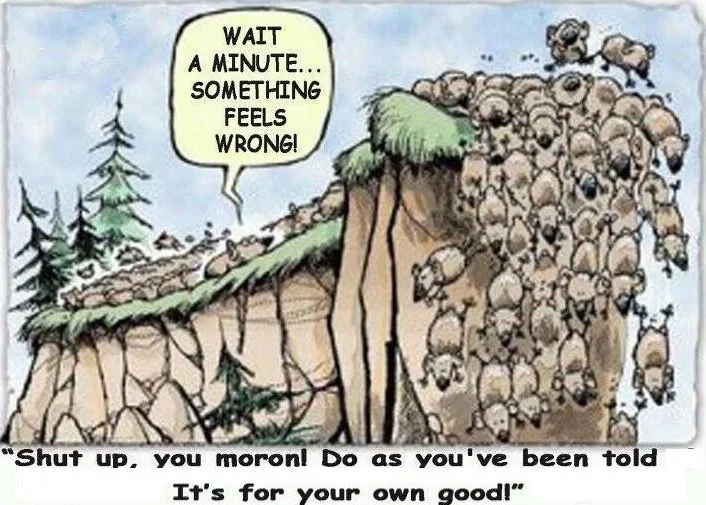

WHEN YOUR ADVISORS ARE CLUELESS - CAN YOU WIN??

What possible reason does Wall Street have to lie to you?

The Endowment Syndrome: Why Elite Funds Are Falling Behind

Per “Enterprising Investor” dated 12/04/2024 by Richard M Ennis, CFA

I’ve been preaching this story for years, it’s very nice to see some “Smart Folks” finally coming to the same realization …. FINALLY!!

I encourage EVERYONE to read the whole article.

It is well written, concise and reiterates my long term statement that we are literally living in the real life book “EMPEROR’S NEW CLOTHES”!

“Elite endowments with heavy allocations to alternative investments are underperforming, losing ground to simple index strategies. High costs, increased competition, and outdated perceptions of superiority are taking a toll. Isn’t it time for a reset?

Endowments with large allocations to alternative investments have underperformed comparable indexed strategies. The average return among the Ivy League schools since the Global Financial Crisis of 2008 was 8.3% per year. An indexed benchmark comprising 85% stocks and 15% bonds, the characteristic allocation of the Ivies, achieved 9.8% per year for the same 16-year period. The annualized difference, or alpha, is -1.5% per year. That adds up to a cumulative opportunity cost of 20% vis-à-vis indexing. That is a big chunk of potential wealth gone missing.[1]

“Endowments in the Casino: Even the Whales Lose at the Alts Table” (Ennis 2024), shows that alternative investments, such as private equity, real estate, and hedge funds, account for the full margin of underperformance of large endowments.

Why do some endowments continue to rely heavily on what has proven to be a losing proposition? Endowment managers with large allocations to alternative investments suffer from what I call the Endowment Syndrome.

Its symptoms include: (1) denial of competitive conditions, (2) willful blindness to cost, and (3) vanity.”

“Competitive Conditions -

In short, private market investing is vastly more competitive than it was … Large endowment managers, however, mostly operate as if nothing has changed. They are in denial of the reality of their markets.”

“Cost -

A[HIGH] all in expense ratio for a diversified portfolio operating in competitive markets is an impossible burden.

Endowments, which don’t report their costs and don’t discuss them as far as I can tell, seem to operate in see-no-evil mode when it comes to cost.”

“Vanity

There exists a notion that the managers of the assets of higher education are exceptional.

A dozen or so schools cultivated the idea that their investment offices were elite, like the institutions themselves.

Others drafted on the leaders, happy to be drawn into a special class of investment pros.

Not long ago, a veteran observer of institutional investing averred:

Endowment funds have long been thought to be the best-managed asset pools in the institutional investment world, employing the most capable people and allocating assets to managers, conventional and alternative, who can and do truly focus on the long run.

Endowments seem particularly well suited to [beating the market]. They pay well, attracting talented and stable staffs. They exist in close proximity to business schools and economics departments, many with Nobel Prize-winning faculty. Managers from all over the world call on them, regarding them as supremely desirable clients.[3]”