SMART STRUCTURE IS:

THE DOGE OF WALL STREET

We’re here TO TEACH YOU to:

TAKE CONTROL OF YOUR FINANCIAL WORLD -

STOP RELYING ON / PAYING FOR WALL STREET’S BULL SH*T

THEY DON’T CARE ABOUT YOU

THEY’RE TAKING YOUR MONEY

AND KEEP YOU STUPID!!

We’re here TO TEACH YOU!!

The Smart Structure Model

Read our “WHAT’S NEW!!

CHECK OUT OUR PILLARS!!

The Smart Structure story

EXPOSES the LIES of WALL STREET

THAT ONLY EXIST to:

MAKE YOU PAY FEES (USUALLY HIDDEN from you) -

FOR BAD ADVICE - WHICH DOES NOT WORK! - but it

Makes MONEY FOR WALL STREET — NOT YOU!!

WHICH KEEPS YOU UNDER THEIR THUMB.

THE GOVERNMENT LIES TO YOU!

WALL STREET LIES TO YOU!

YOUR BANK RIPS YOU OFF!

AND YOU KEEP PAYING THEM!!

ISN’T IT TIME FOR A NEW,

PROVABLE SOLUTION!!

TAKE CONTROL OF YOUR FUTURE!

USE THEIR GAMES AGAINST THEM!!

FREE YOURSELF FROM THE SWAMP!!

DUMP THE BAD

KEEP THE GOOD

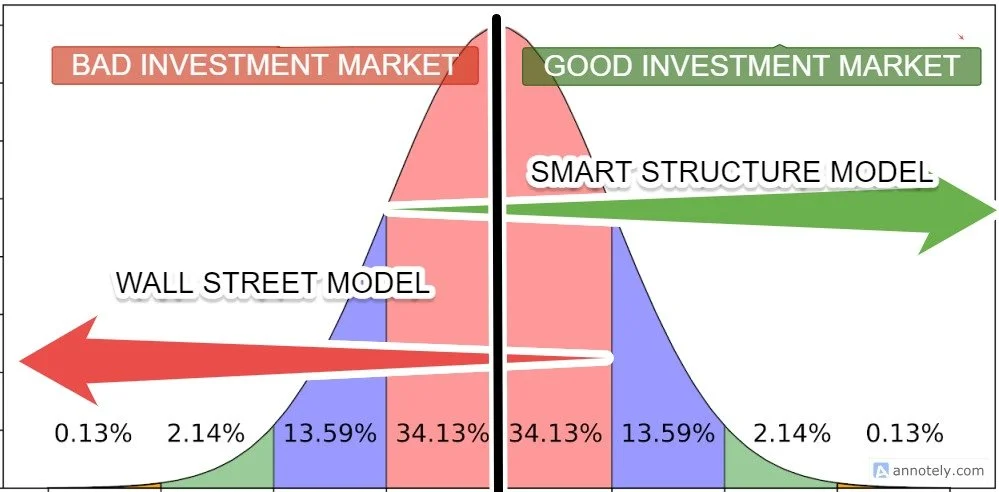

TRUE ASYMMETRIC INVESTING

LIMITED LOSSES - UNLIMITED GAINS

ISN’T THAT THE GOAL?

When you use the Smart Structure Model for your PORTFOLIO,

You’ll NEVER FEAR OR FOOLISHLY REACT TO VOLATILITY AGAIN!

WAS THAT YOUR EXPERIENCE WHEN THE LATEST MINI CRASH MADE THE TALKING HEADS PANIC??

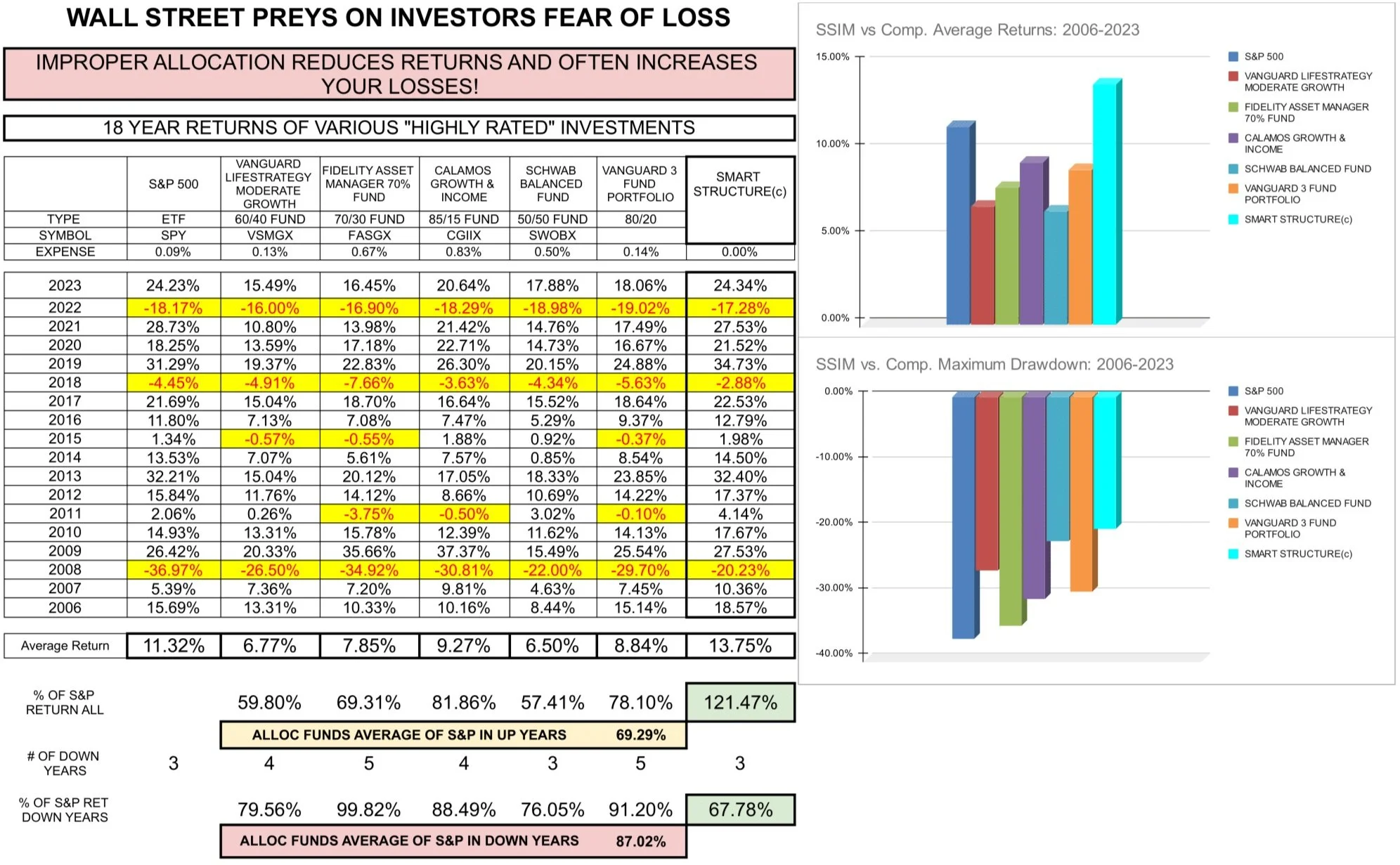

Asset Allocation - Financial "Snake Oil"

Asset Allocation DOES NOT WORK LIKE YOU THINK!

.

I did my own research of what I was told over the years. I threw the data into a spreadsheet and what to my surprise did I find:

TRADITIONAL ASSET ALLOCATION DOES NOT WORK - take a look at these examples (and feel free to plug in ANY Funds from any fund family you choose, EVERY FIRM’S ALLOCATIONS FOLLOW THE SAME PATH, THEY ARE ALL THE SAME - BAD!

TRADITIONAL ALLOCATION LIMITS GAINS - IT DOES NOT LIMIT LOSSES!

ENSURE YOUR PORTFOLIO IS BUILT TO LAST!!

Only a FOOLISH builder builds their house on sand.

Build your financial house on solid rock and it will stand up to any storm.

OUR PILLARS

Performance

Clarity

Efficiency

Our Pillars™ are the foundation of EVERY investor’s custom-built, asymmetric, PROVABLE solution.

Why Smart Structure is different:

Our Model enables you to:

1. Model and implement a portfolio wide solution that COSTS LESS than an Index Fund or ETF!

2. Model and Implement a TOTAL portfolio SOLUTION with only a SMALL FRACTION AT RISK FOR LOSS -

WHILE STILL OUTPERFORMING your INDEX.

This caused a famous Hedge Fund Genius to scream at me: “that’s a hack, you’re beating the system before you start, I can’t show my clients that, they’d NEVER pay me for that!”

I’ve found that Smart People WANT TO Pay for RESULTS -

not the SAME OLD BS STORY = Poor returns and Hidden Fees from the old guard!

3. Implement a TOTAL portfolio SOLUTION where you’ll

add CLARITY and FUNGIBILITY TO YOUR PORTFOLIO

… then you just “SET IT AND FORGET IT!”

(If you’re old enough to remember that)

Our pat pending Structural Solution delivers exactly as designed, so you KNOW exactly where you’ll be in the future - It’s design makes it

OUTPERFORM In UP, DOWN and FLAT Markets.

100% PROVABLE

100% UNDERSTANDABLE

100% GUARANTEED

STOP PAYING the Wall Street CHARLATAINS to RIP YOU OFF!

TAKE CONTROL AND BEAT THEM AT THEIR SYSTEM!

“GIVE A MAN A FISH, HE EATS FOR A DAY.

TEACH A MAN TO FISH AND HE EATS FOR A LIFETIME!”

WE WANT TO HELP YOU TAKE BACK CONTROL OF YOUR FINANCIAL LIFE!

JUST ASK, WE’LL SHOIW YOU THE WAY!

Five basic market “presumptions”:

No one consistently beats the market.

Excess internal costs and fees should be avoided - They eat into returns!

Indexes are the “right choice,” but are EXTREMELY volatile - The more capital you have, the more you worry!

Minimizing taxes is critically important to success - It’s what you KEEP, not what you make.

Complex solutions give more opportunity to fail - Occam’s razor.

So everyone agrees, yet every advisor spits out another allocation-based solution…

Another guess: reviewing the past in hopes of predicting the future.

Their “solutions” REFUSE to address these five market presumptions - BECAUSE …

WHILE YOU WANT A BETTER, CHEAPER, EFFICIENT SOLUTION!

THEY WANT TO SELL YOU THEIR “SOLUTIONS” - VERY EXPENSIVE, COMPLEX, INEFFEFFICIENT, BAD TRACK RECORD

AND YOU LET THEM!

KEEP THE FOX OUT OF THE HENHOUSE!

We’re here to explain, just ask us how!

There’s a fundamental issue with everyone else…

Asset allocation, by definition, and as illustrated by past performance,

LIMITS UPSIDE while INCREASING DOWNSIDE.

Why would anyone do that? It’s 100% backward… It’s the opposite of what you’ve been told!

So, The “Perfect Solution” must:

1. Perform:

RETURNS MATTER - Do not settle for Lower Returns.

Accepting LOWER RETURNS DOES NOT ensure that you’ll have LOWER VOLATILITY!

YOU define your maximal risk/loss (as a % of portfolio, or a real fixed-dollar amount)

Learn how our model enables you to “dial in” your ideal solution.

CONTROL RISK and RETAIN UNLIMITED UPSIDE for your ENTIRE portfolio.

2. Be Efficient:

Our patent pending solution is designed to ensure maximal Long-Term Capital Gains exposure - Minimizing tax effects.

Fixed costs, regardless of portfolio size.

ZERO HIDDEN FEES!

3. Be Clear and Concise:

People DO NOT FEAR what they UNDERSTAND!

We delivers a clear, definitive model, that ensures efficient Capital Gains exposure.

Proper STRUCTURE = EXPECTED outcome - NO SURPRISES!

Embrace VOLATILITY, DO NOT FEAR IT!

Smart Structure Investment Models

~

Dream It

~

Build It

~

Smart Structure Investment Models ~ Dream It ~ Build It ~

What is Smart Structure?

You pay us to unlock the key to asymmetric investing which will drive your financial success. We deliver the STRUCTURE you'll need to succeed in designing and managing your financial life.

So, why is STRUCTURE so important?

Without proper “structure” you are essentially building your financial house on sand. It might be good, but it probably isn’t (based on history). Most people focus on a specific piece of their structure and ignore the rest. The problem is that you never know if you’re actually moving in the right direction. Our Models provide CLARITY for understanding and EFFICIENCY to maximize your plan. SSIM shows you how to build with your PILLARS anchored securely on solid rock.

We call it “SMART” Structure because it is just that. Each Pillar will support YOUR specific financial house - NOT a one size fits all solution. So, while we focus primarily on PERFORMANCE, EFFICIENCY and CLARITY, we help and guide you through your OVERALL model considering Taxes, Estate Planning, Insurance Planning AND Investment planning.

To be truly successful, you must be efficient. You can NOT waste time and/or money. With our Models, EVERY single step that you take BUILDS on your steps taken prior. For example, a typical client’s financial house varies by age, asset size and circumstance. When young, you may be focused on savings. As you age, mortgages and marriages will add complexity that creates the need for proper estate planning (wills and Insurance trusts, etc.). As your assets grow and your life gets more complex, you may need higher level expertise in legal and/or tax matters. The key is to do things CORRECTLY at each and every step of the process.

When PROPERLY structured, EVERYTHING BUILDS on the PROPER BASE that YOU created. Don’t get ahead of yourself. Don’t waste time and money on things that aren’t moving you towards your goals and objectives. Don’t be penny-wise and pound-foolish - this stuff is crucial.

One thing I have learned over the years is that when it comes to TAX ADVICE and LEGAL ADVICE: everyone will pay EARLY for advice or they will pay DEARLY for advice. Do it right the first time… Save yourself a lot of headaches and money.

At Smart Structure Investment Models, we will assist you with these issues. We’ll guide you as these specific issues are EXACTLY the same for EVERYONE - it’s based on US Tax law and US Intestacy laws. Each state will have variations, but a properly designed plan addresses such variations.

So. just like everywhere else in the world, there is a beginning, a middle and an end.

When creating your STRUCTURE - YOU build the beginning properly, YOU adjust if/as things become more complex and/or when needed.

Contact us.

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!

Capital gains, and the common misconceptions associated with them.